Telenor subsidiary Digi and Axiata received approval from the Malaysian Communications and Multimedia Commission (MCMC) to merge their operations, after making concessions to address competition concerns.

In a statement, Telenor said it had addressed preliminary concerns to ensure Malaysia continues to benefit from effective competition.

The merged company will sell back 70MHz of spectrum across the 1,800MHz, 2,100MHz, and 2,600MHz bands to the commission. The first band (1,800MHz) will be returned to the MCMC within 24 months after the merger, and 36 months for the latter two.

A separate independent wholesale business with be established within six months of the merger to ensure the continued access to wholesale services for MVNOs with deals that are “no worse off than existing agreements”.

Celcom’s MVNO Yoodo will have to be sold off after the merger, non-exclusive distributors in the regions of Sabah, Sarawak, Kelantan, Pahang and Terengganu will continue to see service, and the Celcom and Digi brands must be merged into a single brand two years after.

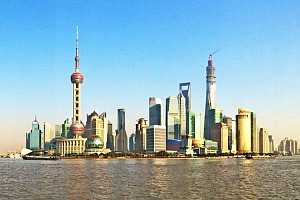

The company will also invest up to MYR250 million (US$56m) over five years to construct an innovation centre in Kuala Lumpur, which will be pivoted to advancing 5G AI and IoT technology. Local start-ups can also leverage the centre to boost their own operations.

Telenor said the next step for the merger will be the approval of the Securities Commission, stock exchange Bursa Malaysia, and both Axiata and Digi shareholders.

Telenor Asia head and EVP Jorgen Arentz Rostrup said: “We have reached a positive milestone in the Malaysian merger process with this regulatory clearance. We are excited to move towards realising the full potential of bringing these two companies together, establishing a commercially stronger and more resilient digital service provider.

“With the proposed structural moves in Thailand and Malaysia, Telenor has a clear ambition to create future-fit companies that can better support ambitious national digital aspirations and bring new, advanced services to consumers across the region.”

Buddecom noted the merger will be beneficial for Malaysia's highly competitive telecoms market.